Research

M-commerce takes off globally, more acutely among Twitter users in all markets

New Twitter survey study highlights contrasts in global m-commerce adoption.

Globally, we have seen the cross-border spread of seasonal shopping dates feuling a rapid growing m-commerce landscape: UAE celebrating White Friday when the US celebrates Black Friday, China’s Singles Day becoming a global online shopping moment, and 12.12 in Indonesia expanding to the Southeast Asia region. We have also seen a significant rise in the role of mobile shopping (m-commerce) as a growing force within the e-commerce world globally. These trends led our Asia Pacific, Middle East, and North Africa research teams to conduct a 15-market study looking into the behaviour and motivations of m-commerce shoppers.

Surveying 7,500 respondents across Brazil, Egypt, France, Germany, Indonesia, India, Malaysia, Mexico, Russia, Saudi Arabia, Spain, Thailand, UAE, UK, and US, the global report delves into mobile shopping behaviours and incorporates an implicit test to understand consumers’ perception towards a list of main shopping apps. The study explores four shopping scenarios that coexist today: 1) Shopping in store and making a purchase in store; 2) Shopping in store and making a purchase on mobile; 3) Shopping on mobile and making a purchase in store; 4) Shopping on mobile and making a purchase on mobile.

Our findings show m-commerce is taking off globally, more acutely among Twitter users in all markets. In the more developing parts of Asia, we have seen a significant adoption of mobile shopping — often most acute amongst those who have less time to physically visit retail outlets. Here are eight key findings from the global m-commerce research, and opportunities that marketers can explore as takeaways:

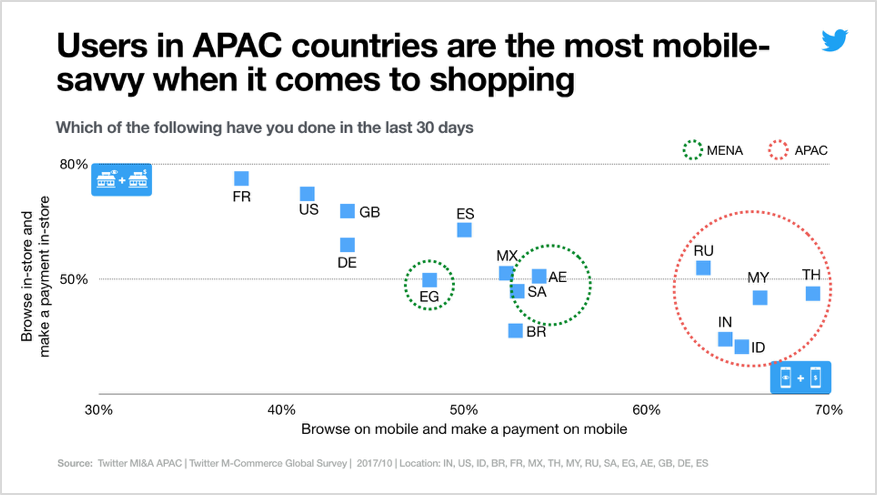

1. Consumers in Asia Pacific are leading global m-commerce adoption.

The results show that consumers globally are browsing more on mobile devices and moving away from making payment in-store to making mobile payments. Consumers surveyed in emerging markets are more likely to adopt m-commerce versus those in developed markets. Specifically in Asia, approximately 2 in 3 Twitter users in Thailand, Indonesia, Malaysia, and India will browse on mobile devices and make mobile payments (as shown in chart below). Marketers need to develop a mobile-first strategy to engage with consumers in Asia.

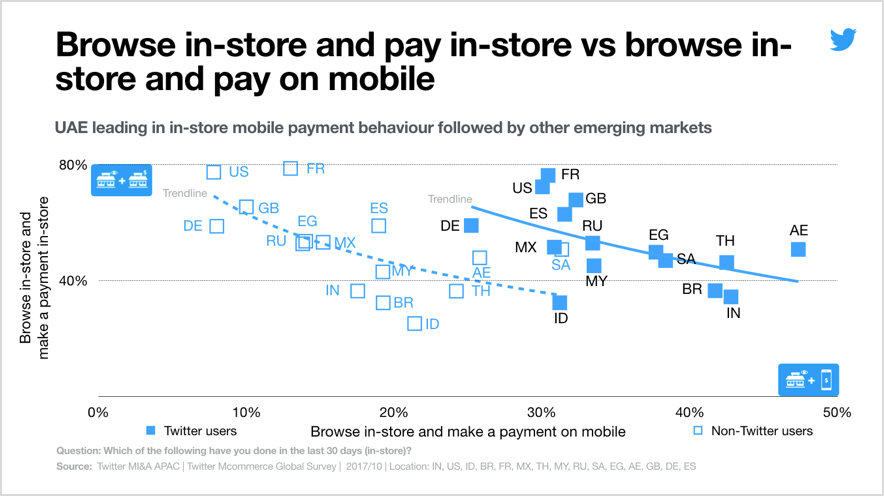

2. Twitter users are more likely than non-users to adopt m-commerce globally.

The research also found that Twitter users surveyed are more likely than non-users to adopt mobile payment in all markets (reference chart below). This is most likely because Twitter is a mobile-first platform and Twitter users are more accustomed to mobile interactions and are generally early adopters of technology. Marketers can extract valuable insight from Twitter users in understanding how their m-commerce strategy can work around the world.

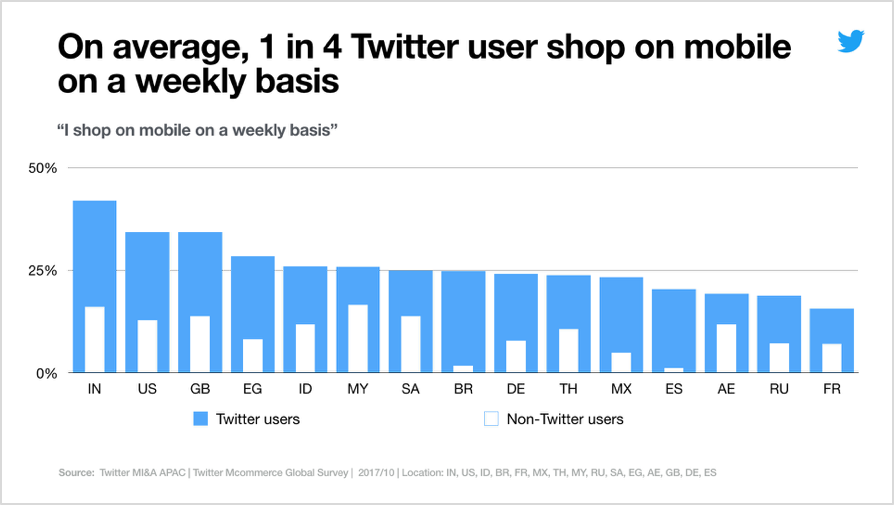

3. On average, 1 in 4 Twitter users shop on mobile on a weekly basis.

Across all surveyed markets, 1 in 4 Twitter users shop on mobile on a weekly basis according to the research. However, the mobile shopping craze is highest in India, where over 40 percent of Twitter users shop on mobile every week, more often than Twitter users in the US and UK. Compared to non-users surveyed, especially in Brazil and Spain, it is clear that Twitter users love mobile shopping.

4. India’s Twitter users lead in mobile shopping adoption among those surveyed.

According to the research, India’s Twitter users lead in mobile shopping behaviour as 81 percent of Twitter users in India surveyed are likely to shop on mobile. This is congruent with recent eMarketer data which also shows m-commerce sales growth in India ahead of other markets globally (source: Worldwide Retail and E-commerce Sales: eMarketer's Estimates for 2016–2021). As mobile internet penetration continues to grow in the market, marketers keen to tap into India’s rising mobile population will need to find ways to reach these mobile-savvy consumers and provide a compelling mobile shopping experience.

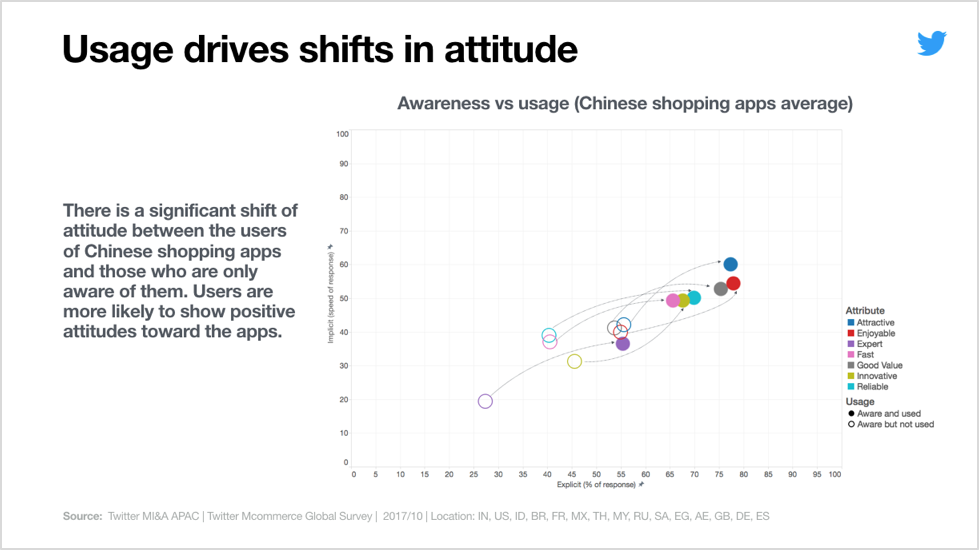

5. When users cross into usage is the key driver in increases in brand perception and attitude. New entrants are especially benefitting new Chinese shopping apps.

There is a significant difference in attitudes between those who are aware of the Chinese shopping apps and those who have used them. Consumers have shown a positive shift in attitudes towards the Chinese shopping apps after using them. Marketers — and more specifically, Chinese m-commerce players — should encourage more app downloads and mobile shopping trials among overseas shoppers.

6. Communication from brands plays a significant role on the platform.

According to research, 66 percent of Twitter users state that one of the reasons they open Twitter is to know ‘what’s happening with brands’. This percentage goes up to 75 percent in markets like KSA and India. With the knowledge of brand receptivity on Twitter, there is positive value to marketers to have their brands on the platform across the globe, reaching and engaging with audiences worldwide.

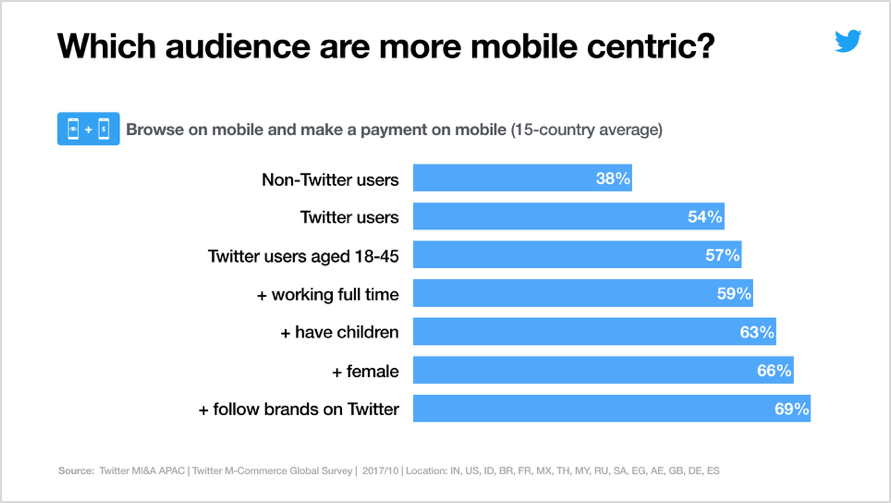

7. Twitter users that follow brands on the platform are the most mobile-centric.

The survey further shows that a wide range of factors could affect the mobile shopping behaviour of Twitter users. For example, 69 percent of users surveyed are most likely to browse and pay via mobile devices if they are females aged 18-45, with children, who work full time and follow brands on Twitter. In comparison, only 38 percent of non-Twitter users are likely to do the same. Marketers interested in mobile shoppers could look into audience targeting for Twitter users that follow similar brands on Twitter.

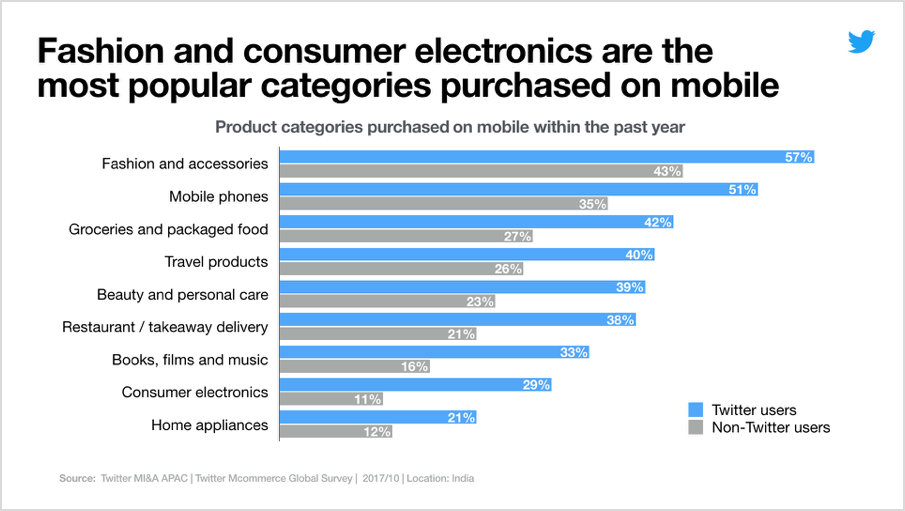

8. Fashion and consumer electronics are the most popular categories purchased on mobile.

The study shows that shopping for fashion and consumer electronics and making purchases for them on mobile is a behaviour that’s consistent across Twitter and non-Twitter users surveyed. Specifically, fashion and accessories top the list of most popular categories purchased on mobile in the past year, with mobile phones, groceries and packaged food, travel products, and beauty and personal care rounding up the top five. Marketers in these industries should pay extra attention to mobile shoppers and design their customer journey to include mobile and social customer experiences on Twitter.

Methodology

This study surveyed 7,500 respondents across Brazil, Egypt, France, Germany, Indonesia, India, Malaysia, Mexico, Russia, Saudi Arabia, Spain, Thailand, UAE, UK, and US on mobile shopping behaviours and incorporated an implicit test to understand consumers’ perception towards a list of main shopping apps.