Insights

A new normal for B2B marketers is here

It feels like an understatement to say that over the course of the last year, a lot of things have changed. For B2B tech marketers especially, the pandemic disrupted the way they work, changed the way buyers and marketers interact, and challenged them in unpredictable ways. To better understand these changes, Twitter teamed up with Bain & Company on a year-long study to ask marketers and buyers how the pandemic was impacting their work. Specifically, we fielded three surveys over the course of the year to get a sense of emerging trends and patterns.

The good news: both marketers and buyers are clearly getting into a groove after more than a year of constant pivoting. But some have fared better than others, and a deep dive into the survey results paints a helpful picture of how B2B marketers can continue to thrive in a new normal.

How B2B evolved during a year of change

Getting back on track

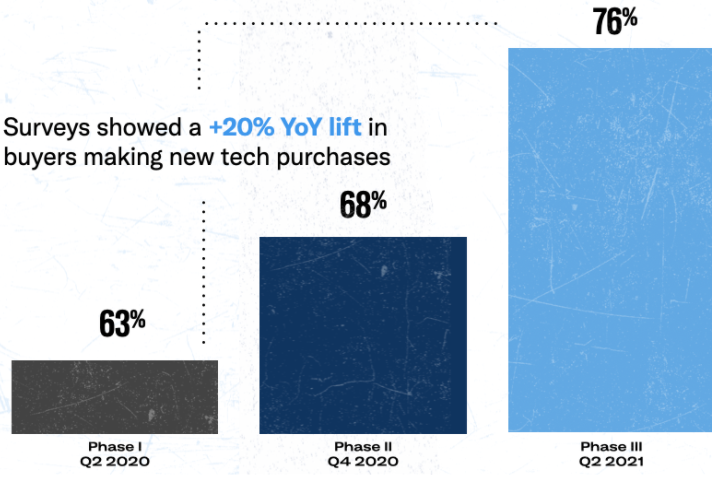

Our surveys confirmed that both buyers and marketers got a boost of energy as they made their way into the new year. Across our surveys from Q2 2020 to Q2 2021, we observed a 200% lift year-over-year in the number of respondents reporting an increase in revenue.1

In fact, the most recent survey confirmed that 76% of respondents on the buyer side were actively making new tech purchases. That’s a 20% lift since last year.2

In a world of change, some things have stayed the same.

There’s an instinct to focus all attention on how much has changed, but what’s so interesting about this study is it revealed how some things in the B2B market haven’t changed at all. For instance, when it comes to new purchases, buyers told us consistently that they still depend on their own community inputs, above all other sources, for purchasing guidance. In fact, a staggeringly high 99% trust their peers more than any other source.3 So it’s important for B2B marketers to not only think about reaching a few targeted decision makers directly but focus on building broader awareness and credibility in the B2B community.

Another consistent trend we noticed was a disconnect in B2B marketer’s understanding of who is making key decisions on the buyer side. While B2B marketers often obsess over reaching senior decision makers, buyers consistently told us that middle managers play a significant role in guiding purchase decisions. Half of the B2B buyers we surveyed said their manager-level colleagues have serious clout when it comes to technology purchasing decisions.4 This was a constant refrain throughout the pandemic, and that dynamic may not change after the pandemic is over.

But some things really did change...

Facing economic disruption and fast-shifting budgets, the demand on marketers clearly increased during the pandemic. Over half of marketing respondents said that the targets of their pipelines and campaigns have increased since Q2 2020.5 What’s more, their tactics had to evolve: With an entire buying community suddenly working from home and in-person events a remote possibility, B2B marketers had to get a lot more nimble in how they reached buyers.

One way they did it was by investing more in digital channels like social media and using those channels for things like brand building and empathetic messaging.6 Another way was by pivoting their in-person conferences to a virtual setting. In many cases they used social media platforms as the hosting ground for global conferences. Around 87% of marketers reported an increased investment in virtual events — a shift that is expected to be permanent because of its success.7

This is how B2B marketers move forward and adapt

Lead with empathy.

Demand generation will always be an important component of B2B marketing, but we found that the top marketers in our study focused on how to speak to their customers as people, not ad targets. In many cases, they pivoted their messaging to pandemic-related content that spoke to what people were going through in their daily lives.

One brand that did this effectively was Slack through their #ReinventWork campaign. The series reminaged the future of remote work as well as providing tips and tricks on how to remain both productive and happy.

Invest in your brand.

The pandemic has shown us that the world can change in an instant, and surviving rapid change means investing in the one thing that is most likely to weather it — your brand. Our survey showed that over 60% of B2B marketers said they increased investment in digital channels as a way to boost brand awareness, and nearly 70% expect this change to be permanent.8

Salesforce, for example, introduced the Leading Through Change thought leadership series, which proved to be an invaluable resource for the B2B marketing community as their environment rapidly evolved. It was a resource created not to sell any particular product but to raise the profile of the Salesforce brand in a positive way.

Virtual events aren’t going anywhere.

Based on our research, it’s safe to say we’re headed toward a future of hybrid events, with some IRL attendance and some taking advantage of the virtual offerings available. Because as it turns out, it’s what buyers would prefer anyway, with 64% saying that they would continue to attend virtual events.9

In some instances, virtual events can not only provide greater audience reach but can also foster connections between attendees. Microsoft experienced this firsthand as they moved their popular #MSBuild and #MSIgnite conferences online as virtual events.

“Moving our events from in-person to virtual gave us the ability to reach a global audience, while using our social channels as an extension of the event. This made the experience more accessible for everyone,” Joanna YeeHuiSze, Director of Events Marketing Communications at Microsoft, described.

This newfound accessibility had a positive impact on attendance.

“The attendance rate can go up over 10 times higher than a physical event could. We were blown away by the reception and appetite, which resulted in a complete shift in our audience composition. Historically, our events breakdown is 80% US and 20% global; today that mix is 70% US and 30% global,” YeeHuiSze explained.

Microsoft also found that virtual events could yield more informative audience and behavioral data.

“Data is so crucial in decision making for the future,” YeeHuiSze said. “We’re able to collect useful information such as knowing which sessions were well attended, on-demand viewership, and topics of interest through polling features. This really allows you to get to know your audience better and tailor the experience to meet their needs.”

Building on the success of #MSBuild and #MSIgnite, Microsoft intends to continue adding a virtual layer to all future events, even when conferences return to in-person.

“We believe that this kind of approach to events and experiences works well,” YeeHuiSze added. “It has such incredible potential for growth. We see this quickly becoming the center of our events strategy for both our online and in person experiences, offering an effective, interactive, and unique experience for all.”

Clearly, we’ve entered into a new normal for B2B buyers and marketers, where empathetic marketing, brand building in digital channels, and virtual events are here to stay.

About the author: Christian Eberhardt, Director, Tech and Telco at Twitter

Christian Eberhardt (@eberhardt) leads the Technology Client Solutions team at Twitter, partnering with brands such as Google, Microsoft, Apple and Salesforce. Prior to Twitter, Christian held leadership and business development positions at Microsoft and Amazon.

Sources

1 Bain/Twitter Technology Purchasing Trends Buyer Survey (Phase I, N=289; Phase II, N=284; Phase III, N=250), April 2021. B Q18: How COVID has impacted the revenue of your company's products/ services in the past 3 months? Increased moderately, increased significantly.

2 Source: Bain/Twitter Technology Purchasing Trends Buyer Survey (Phase I, N=289; Phase III, N=250), April 2021. B Q19: Are you currently taking any of the following actions? Making new tech purchases.

3 Bain/Twitter Technology Purchasing Trends Buyer Survey (N=100), April 2021. B Q6: What are the most trusted sources of input in your discovery of new products/ services for your company?

4 Bain Technology Purchasing Trends Survey Phase II (N=300)

5 Bain/Twitter Technology Purchasing Trends Marketer Survey (N=100), April 2021. M Q11: How have marketing targets changed since the beginning of COVID?

6 Bain/Twitter Technology Purchasing Trends Marketer Survey (N=100), April 2021. M Q11: How have marketing targets changed since the beginning of COVID?

7 Bain/Twitter Technology Purchasing Trends Marketer Survey (N=100), April 2021. M Q18: Which of the following marketing activities have you decreased, increased, or have remained about the same since the beginning of COVID?

8 Bain/Twitter Technology Purchasing Trends Marketer Survey (N=100), April 2021. M Q18: Which of the following marketing activities have you decreased, increased, or have remained about the same since the beginning of COVID? Which of these changes do you think will be permanent post-COVID?

9 Bain/Twitter Technology Purchasing Trends Buyer Survey (N=250), April 2021. B Q9: Relative to pre-COVID, how likely are you to attend virtual events in the future